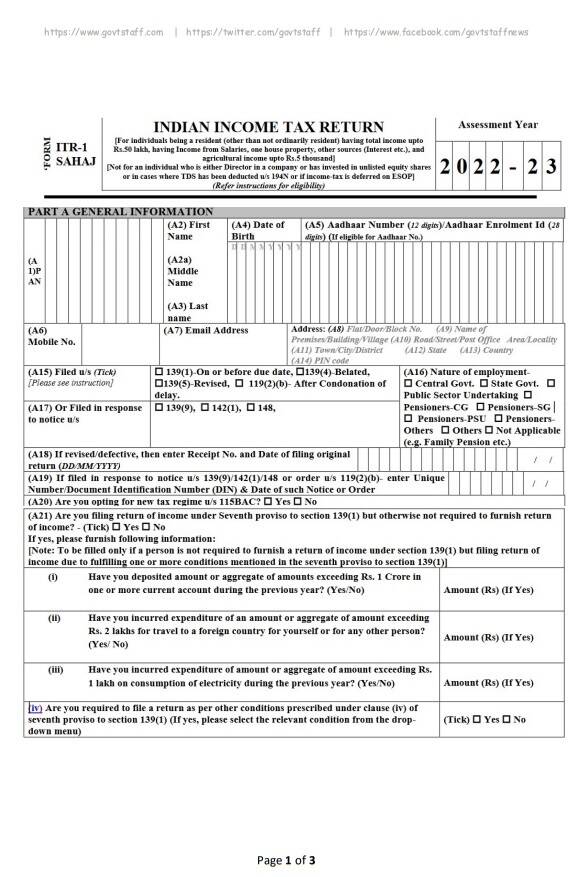

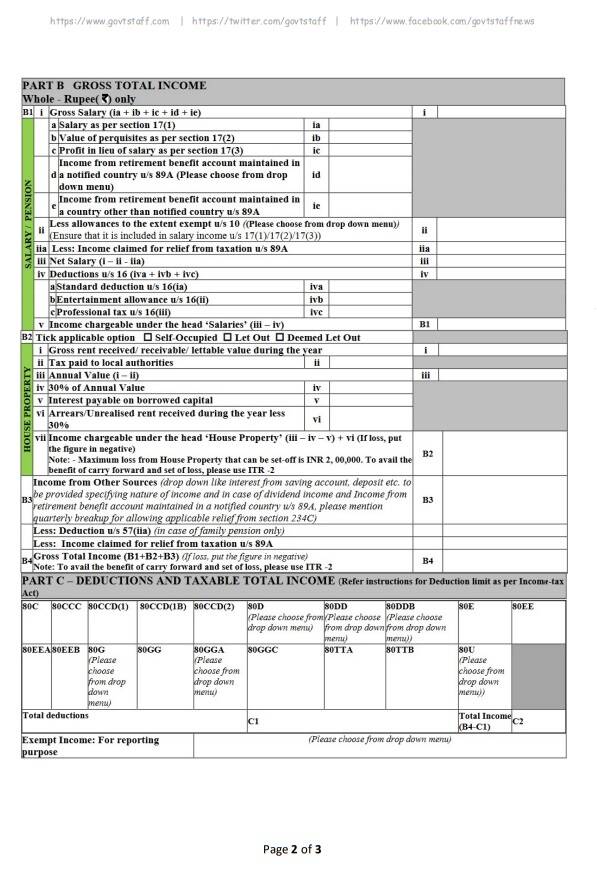

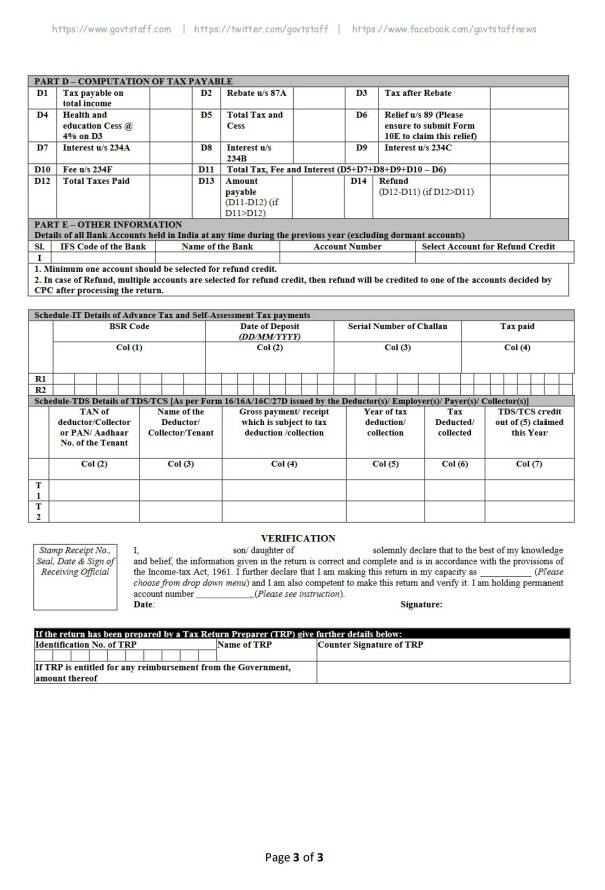

Income Tax Forms SAHAJ ITR-1, ITR-2, ITR-3, SUGAM ITR-4, ITR-5 & ITR-6 for Assessment Year 2022-23 (F.Y. 2021-22)

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 30th March, 2022

G.S.R 231(E).—In exercise of the powers conferred by section 139 read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend Income-tax Rules, 1962, namely:-

1. Short title and commencement.—(1) These rules may be called the Income-tax (fourth Amendment) Rules, 2022.

(2) They shall come into force with effect from the 1st day of April, 2022.

2. In the Income-tax Rules, 1962 (hereinafter referred to as the principal rules), in rule 12,–

(a) in sub-rule (1), in the opening portion, for the figure “2021”, the figure “2022” shall be substituted;

(b) in sub-rule (5), for the figure “2020”, the figure “2021” shall be substituted.

3. In the principal rules, in Appendix-II, for Forms SAHAJ ITR-1, ITR-2, ITR-3, SUGAM ITR-4. ITR-5, ITR-6, ITR-V and ITR- Ack, the following Forms shall, respectively, be substituted, namely:—

Click to view/download ITR-1 in PDF

Source: https://incometaxindia.gov.in

COMMENTS