Income Tax: Exercise of Options for choosing Old and New regimes of Income Tax during F.Y. 2020-21

कार्यात्रय रक्षा लेखा नियंत्रक :

OFFICE OF THE CONTROLLER OF DEFENCE ACCOUNTS

नं. 1 स्टाफ रोड, सिकंदराबाद -800 009

NO.1, STAFF ROAD, SECUNDERABAD – 500 009.

No: Paytech/4058/Circular/IT

Date: 14.09.2020

IMPORTANT CIRCULAR

(INCOME TAX FOR FY – 2020-21)

To,

The PAY Sections (LOCAL) ,

AAO (Army) Visakhapatnam ,

All AAO/AO – AGE/GE’s Offices and

All Units located at Secunderabad/ Visakhapatnam

Eddumailaram/Suryalanka under

CDA Secunderabad

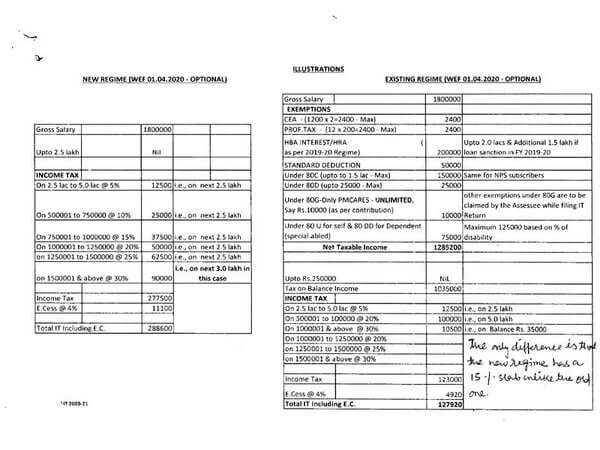

Attention is drawn to the section- 115BAC, Income-tax Act, 1961-2020, under which a taxpayer has option for choosing from two types of Income Tax deductions, Viz., the rate/calculation upto FY 31.03.2020 and w.e-f., 01.04.2020. A chart illustrating the difference between the old and new regimes of Income Tax is enclosed herewith for reference along with a comparative statement showing difference of Income Tax between both patterns.

All the officers and staff are hereby requested to exercise their option quoting ‘Old’/ ‘New’ and submit IT statements for FY 2020-21 (If opted old scheme enclose all copies of proofs in support of deductions claimed) on or before 31.10.2020. The option once exercised will be final upto the end of Financial Year i.e., 31.03.2021 (paybill month 02/2021). While exercising option, the assessee may satisfy himself as to which regime to be chosen after careful application of following guidelines.

1. The new regime which does not take into account any type of exemptions and IT will be calculated on the Gross Salary.

2. The old regime will continue to take into account all the exemptions applicable upto FY 2019-20.

Encl:- Copy of illustrations.

ACCOUNTS OFFICER (Pay Tech)

Copy to:

The SAO, IT SECTION LOCAL For uploading in the website please.

ACCOUNTS OFFICER (Pay Tech)

Source: CDA

https://cdasecbad.ap.nic.in/circulars/pt_IT_Circular_FY_2020_21.pdf

COMMENTS