Tag: IRTSA

Question Answer session on CCS (Pension) Rules, 2021 – Minutes of meeting (VC) dated 25.1.2022

Question Answer session on CCS (Pension) Rules, 2021 - Minutes of meeting (VC) dated 25.1.2022

S.No.

Query/ Suggestion

Reply

1.

Shri ...

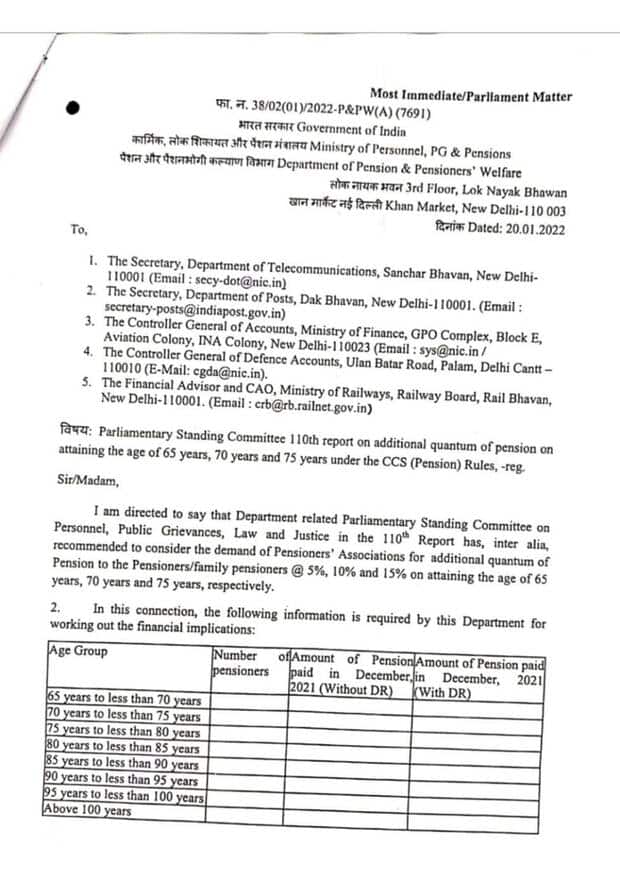

Additional quantum of pension on attaining the age of 65 years, 70 years and 75 years under the CCS (Pension) Rules – Parliamentary Standing Committee 110th report

Additional quantum of pension on attaining the age of 65 years, 70 years and 75 years under the CCS (Pension) Rules - Parliamentary Standing Committee ...

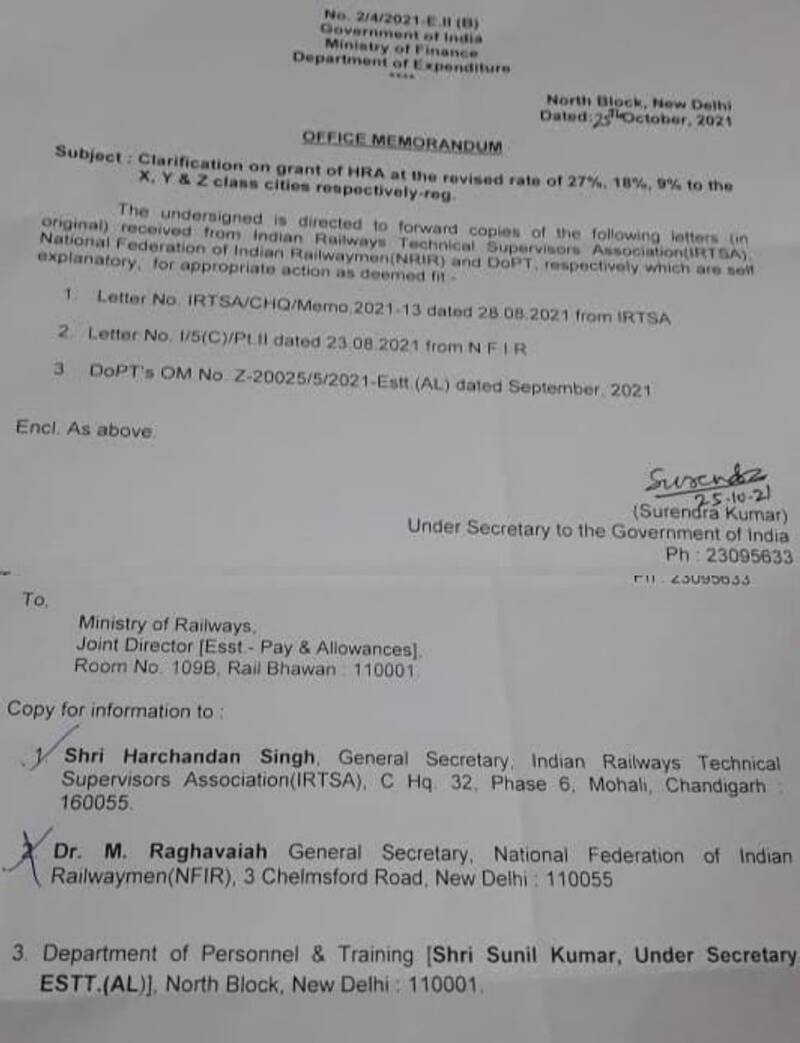

Grant of HRA at the revised rates to 27%, 18% and 9% for X, Y & Z class cities w.e.f. 1st January 2021: Latest updates

Grant of HRA at the revised rates to 27%, 18% and 9% for X, Y & Z class cities w.e.f. 1st January 2021: Latest updates

Finance Ministry forwards ...

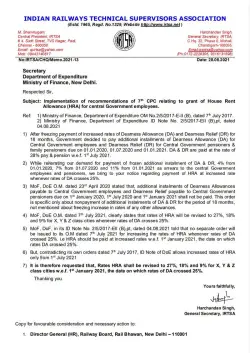

7th CPC House Rent Allowance (HRA) @ 27%, 18% and 9% for X, Y & Z class cities w.e.f. 1st January 2021: IRTSA writes to FinMin

7th CPC House Rent Allowance (HRA) @ 27%, 18% and 9% for X, Y & Z class cities w.e.f. 1st January 2021: IRTSA writes to FinMin

INDIAN RAILWAYS TE ...

Issuance of Privilege Pass Surrender Certificate (PPSC) and availing of Special Cash Package – IRTSA seeks clarification from Railway Board

Issuance of Privilege Pass Surrender Certificate (PPSC) and availing of Special Cash Package - IRTSA seeks clarification from Railway Board

INDIAN RA ...

Rationalisation of Tax free Income on Provident Funds: IRTSA writes to Finance Minister

Rationalisation of Tax free Income on Provident Funds: IRTSA writes to Finance Minister

INDIAN RAILWAYS TECHNICAL SUPERVISORS ASSOCIATION

(Estd. 196 ...

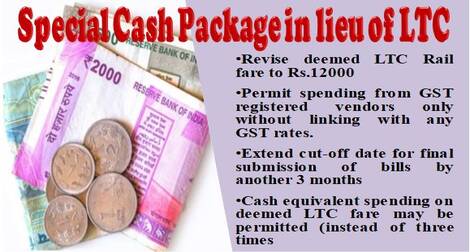

Revise Deemed LTC Rail fare per person to Rs. 12,000 – IRTSA writes to Secretary, Finance

Revise Deemed LTC Rail fare per person to Rs. 12,000 - IRTSA writes to Secretary, Finance

INDIAN RAILWAYS TECHNICAL SUPERVISORS ASSOCIATION

(Estd. 1 ...

Medical Insurance Scheme for Railway Employees – IRTSA writes to Railway Board

Medical Insurance Scheme for Railway Employees - IRTSA writes to Railway Board

INDIAN RAILWAYS TECHNICAL SUPERVISORS ASSOCIATION

(Estd. 1965, Regd. ...

7th CPC Night Duty Allowance : Removal of ceiling for entitlement – IRTSA writes to the Chairman, Railway Board

7th CPC Night Duty Allowance : Removal of ceiling for entitlement - IRTSA writes to the Chairman, Railway Board

INDIAN RAILWAYS TECHNICAL S ...

IRTSA : Combined Cadre Restructuring of Group A, B and C services on the Railways

IRTSA : Combined Cadre Restructuring of Group A, B and C services on the Railways

INDIAN RAILWAYS TECHNICAL SUPERVISORS

ASSOCIATION

(Estd. 1965, ...