Tag: Income Tax

Income-tax (Sixth Amendment) Rules, 2023 – CBDT Notification dated 29.05.2023

Income-tax (Sixth Amendment) Rules, 2023 regarding change the head authority for implementation of e-Appeals Scheme, 2023

MINISTRY OF FINANCE

(Depar ...

Provisions relating to Charitable and Religious Trusts – Clarification by CBDT vide Circular No. 6 of 2023

Provisions relating to Charitable and Religious Trusts - Clarification by CBDT vide Circular No. 6 of 2023

Circular No. 6 of 2023

F. No.370133/06/20 ...

Deduction of TDS under section 192 read with sub-section (1A) of section 115BAC of the Income-tax Act 1961 – Clarification by CBDT vide Circular No. 04 of 2023

Deduction of TDS under section 192 read with sub-section (1A) of section 115BAC of the Income-tax Act 1961 - Clarification by CBDT vide Circular No. 0 ...

Procedure, format and standards for filling an application in Form No. 15C or Form No. 15D for grant of certificate for no-deduction of income-tax under sub-section (3) of section 195 of the Income Tax Act, 1961 through TRACES – IT Notification No. 01/2023

Procedure, format and standards for filling an application in Form No. 15C or Form No. 15D for grant of certificate for no-deduction of income-tax und ...

Income-tax (Fourth Amendment) Rules, 2023 – Rules 114AAA – Manner of making permanent account number inoperative: IT Notification No. 15/2023

Income-tax (Fourth Amendment) Rules, 2023 – Rules 114AAA – Manner of making permanent account number inoperative: IT Notification No. 15/2023 dated 28 ...

Stop becoming your PAN inoperative – See the consequences vide CBDT Circular No. 03 of 2023

Stop becoming your PAN inoperative - See the consequences vide CBDT Circular No. 03 of 2023

Circular No. 03 of 2023

F. No. 370142/14/2022-TPL

Gover ...

31 मार्च तक पैन को आधार से लिंक कर लें – आयकर विभाग की अपील

31 मार्च तक पैन को आधार से लिंक कर लें – आयकर विभाग की अपील

Last dated to link your PAN and AADHAAR is approaching soon

पैन कार्ड को आधार नंबर से जो ...

Assessing and regularization of Income Tax for the F.Y- 2023-2024: DAD Circular No. 27

Assessing and regularization of Income Tax for the F.Y- 2023-2024: DAD Circular No. 27

Government of India

Ministry of Defence

Controller of Defenc ...

Income Tax on GPF accumulation – CGDA order dated 27.02.2023

Income Tax on GPF accumulation - CGDA order dated 27.02.2023

र्यालय, रक्षा लेखा महानियंत्रक

उलान बटा रोड, पालम, दिल्ली छावनी - 110010

Office of Co ...

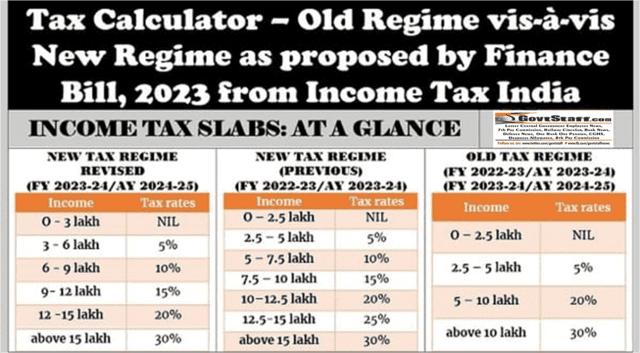

Income Tax Calculator – Old Regime vis-à-vis New Regime as proposed by Finance Bill, 2023 from IncomeTaxIndia

Income Tax Calculator – Old Regime vis-à-vis New Regime as proposed by Finance Bill, 2023 from IncomeTaxIndia

Finance Minister Nirmala Sitharaman has ...