Tag: Income Tax

Deduction of Income-tax at any lower rate or no deduction of Income-tax under sub-section (1) of section 197 of the Income-tax Act, 1961 through TRACES – Procedure, format and standards for filling an application for grant of certificate under sub-rule (4) and its proviso of Rule 28AA of Income Tax Rules, 1962

Deduction of Income-tax at any lower rate or no deduction of Income-tax under sub-section (1) of section 197 of the Income-tax Act, 1961 through TRACE ...

Bank Account Validation Status for Refund – Income Tax Message dated 13-Sep-2023

Bank Account Validation Status for Refund – Income Tax Message dated 13-Sep-2023

Check Bank A/c validation Status For Refund.

Has your bank merged ...

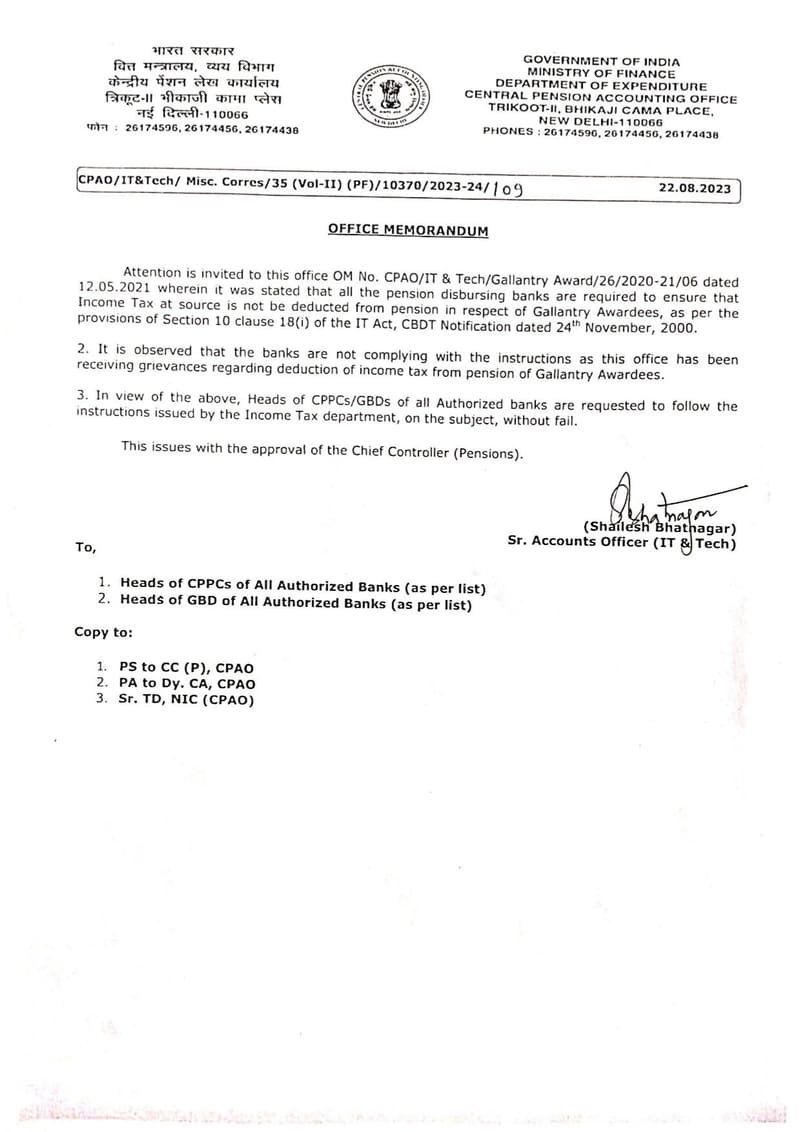

Pension in respect of Gallantry Awardees – Income Tax is not deductible from pension in respect of Gallantry Awardees : CPAO writes to Bank dt 22.08.2023

Pension in respect of Gallantry Awardees – Income Tax is not deductible from pension in respect of Gallantry Awardees : CPAO writes to Bank dt 22.08.2 ...

Income tax (Eighteenth Amendment), Rules, 2023: Perquisites – Valuation of residential accommodation provided by the employer

Income tax (Eighteenth Amendment), Rules, 2023: Perquisites – Valuation of residential accommodation provided by the employer

MINISTRY OF FINANCE

(D ...

Income-tax (Seventeenth Amendment) Rules, 2023 – Rate of exchange for the purpose of deduction of tax at source on income payable in foreign currency

Income-tax (Seventeenth Amendment) Rules, 2023 – Rate of exchange for the purpose of deduction of tax at source on income payable in foreign currency

...

Income tax Amendment (Sixteenth Amendment) Rules, 2023: Computation of income tax for sum received under a life insurance policy

Income tax Amendment (Sixteenth Amendment) Rules, 2023: Computation of income tax for sum received under a life insurance policy

MINISTRY OF FINANCE

...

Guidelines under clause (10D) of section 10 of the Income-tax Act, 1961 – Exemption of Income-tax on any sum received under a Life Insurance Policy : CBDT Circular No. 15 of 2023

Guidelines under clause (10D) of section 10 of the Income-tax Act, 1961 – Exemption of Income-tax on any sum received under a Life Insurance Policy : ...

Treatment of promotion to the grade of OS/Steno Grade-I for MACP entitlement – Withdrawal of MACP and waiver of recovery: CBDT

Treatment of promotion to the grade of OS/Steno Grade-I for MACP entitlement – Withdrawal of MACP and waiver of recovery: CBDT

प्रधान मुख्य आयकर आयु ...

Income-tax (Thirteenth Amendment) Rules, 2023 – CBDT Notification

Income-tax (Thirteenth Amendment) Rules, 2023 - CBDT Notification

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOT ...

Extension of time limits for submission of certain TDS/TCS Statements: IT Circular No. 9/2023 under section 119 of the Income-tax Act, 1961

Extension of time limits for submission of certain TDS/TCS Statements: IT Circular No. 9/2023 under section 119 of the Income-tax Act, 1961

Circular ...