Tag: Income Tax

Income Tax Return: अब 30 सितंबर तक भर सकेंगे 2018-19 का ITR, पहले इसे 31 जुलाई तक दाखिल करना था, वित्त वर्ष 2019-20 के लिए आयकर रिटर्न भरने की तारीख पहले ही बढ़ा दी गई थी

Income Tax Return: अब 30 सितंबर तक भर सकेंगे 2018-19 का ITR, पहले इसे 31 जुलाई तक दाखिल करना था, वित्त वर्ष 2019-20 के लिए आयकर रिटर्न भरने की तारीख प ...

Income Tax Circular No. 13/2020 : One-time relaxation for AY 2015-16 to 2019-20 which are pending due to non-filing of ITR V form and processing of such returns

Income Tax Circular No. 13/2020 : One-time relaxation for AY 2015-16 to 2019-20 which are pending due to non-filing of ITR V form and processing of s ...

Rule 12CB of IT Act 1962 – Income-tax (18th Amendment) Rules, 2020: Statement of income paid or credited by an investment fund to its unit holder

Rule 12CB of IT Act 1962 – Income-tax (18th Amendment) Rules, 2020: Statement of income paid or credited by an investment fund to its unit holder

MIN ...

Clarification in relation to notification issued under clause (v): Section 194N of the Income-tax Act, 1961

Clarification in relation to notification issued under clause (v): Section 194N of the Income-tax Act, 1961

Circular no. 14/2020

F.No. 370142/27/202 ...

CBDT Order: Processing of returns with refund claims under section 143(1) of the Income-tax Act,1961 beyond the prescribed time limits in non-scrutiny cases-regd.

CBDT Order: Processing of returns with refund claims under section 143(1) of the Income-tax Act,1961 beyond the prescribed time limits in non-scrutiny ...

Income Tax: Format of Self Declaration for Option for Deduction of Tax during the Financial Year 2020-21

Income Tax: Format of Self Declaration for Option for Deduction of Tax during the Financial Year 2020-21 (Assessment Year: 2021-22)

Office of the Pri ...

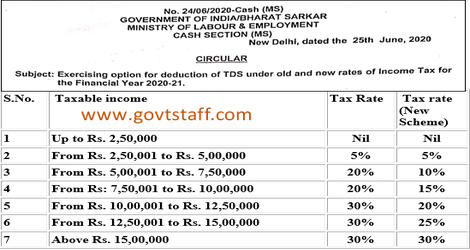

Exercising option for deduction of TDS under old and new rates of Income Tax for F.Y. 2020-21 – Ministry of Labour Circular

Exercising option for deduction of TDS under old and new rates of Income Tax for F.Y. 2020-21 - Ministry of Labour Circular

No. 24/06/2020-C ...

Option for Income-tax under section 115 BAC of the new tax regime: Amendment notification number 38/2020 / नई कर व्यवस्था के तहत आय-कर अधिनियम की धारा 115 बीएसी के अंतर्गत विकल्प के संबंध में: संशोधन अधिसूचना संख्या 38/2020

Option for Income-tax under section 115 BAC of the new tax regime: Amendment notification number 38/2020 / नई कर व्यवस्था के तहत आय-कर अधिनियम की धार ...