Tag: GPF

Calculation of Income Tax on Interest of GPF – Implementation of CBDT notification regarding

Calculation of Income Tax on Interest of GPF - Implementation of CBDT notification regarding

कार्यालय, रक्षा लेखा नियंत्रक गुवाहाटी, उदयन विहार, ना ...

Issuance of Annual Statement of GPF Account (CCO-9) for FY 2021-22 on the 1st April, 2022 – reg.

Issuance of Annual Statement of GPF Account (CCO-9) for FY 2021-22 on the 1st April, 2022 - reg.

IMPORTANT CIRCULAR

रक्षा मंत्रालय / Ministry of Def ...

Calculation of Income Tax on Interest of GPF on contribution above Rs. 5 Lakhs

Calculation of Income Tax on Interest of GPF on contribution above Rs. 5 Lakhs

Defence Accounts Department (DAD) Headquarters

Ulan Batar Road, Palam ...

Rate of Interest on General Provident Fund (GPF) and other similar funds for the last quarter of FY 2021-22

Rate of Interest on General Provident Fund (GPF) and other similar funds for the last quarter of FY 2021-22

(TO BE PUBLISHED IN PART I SECTION 1 OF ...

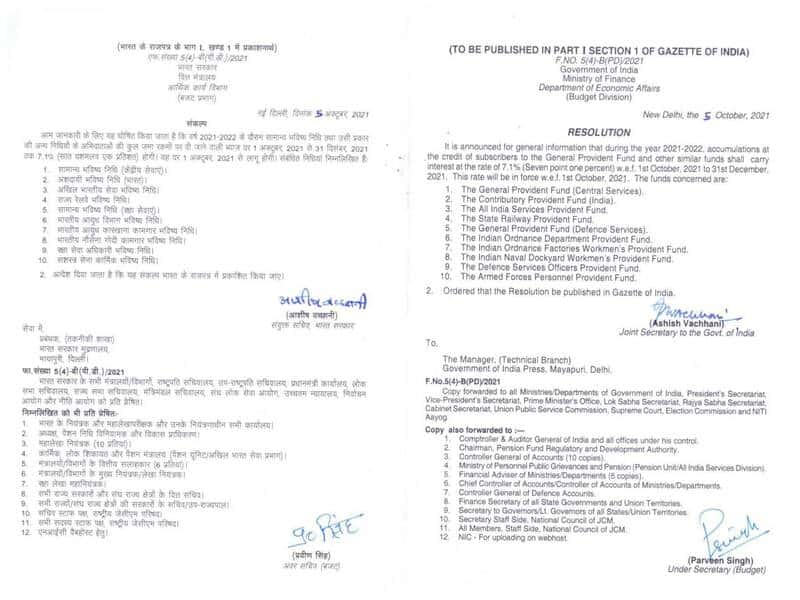

Rate of Interest on GPF and other similar funds for Q3 of FY 2021-22 from 1st Oct 2021 to 31st Dec 2021

Rate of Interest on GPF and other similar funds for Q3 of FY 2021-22 from 1st Oct 2021 to 31st Dec 2021

(TO BE PUBLISHED IN PART I SECTION 1 OF GAZET ...

Common Nomination Form for Gratuity, General Provident Fund and Central Government Employees’ Group Insurance Scheme – Form 1

Common Nomination Form for Gratuity, General Provident Fund and Central Government Employees’ Group Insurance Scheme – Form 1

Form 1

Common Nominati ...

Payment of amount of Ex-Gratia lump sum compensation on death of performance of bona fide official duty – Provision for nomination: DoP&PW

Payment of amount of Ex-Gratia lump sum compensation on death of performance of bona fide official duty – Provision for nomination: DoP&PW

F.No. ...

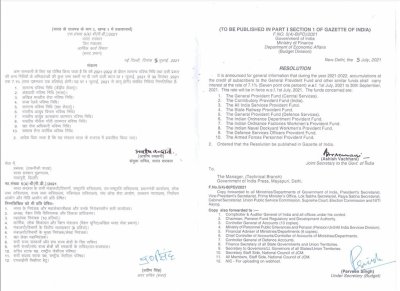

Rate of Interest on GPF and other similar funds w.e.f. 1st July, 2021 for 2nd Quarter of financial year 2021-2022

Rate of Interest on GPF and other similar funds w.e.f. 1st July, 2021 for 2nd Quarter of financial year 2021-2022

(TO BE PUBLISHED IN PART I SECTION ...

PF tax ceiling will be applicable to GPF as well: CBDT chairman

PF tax ceiling will be applicable to GPF as well: CBDT chairman

Budget 2021-22 has rationalised tax-free income on provident fund contribution by hig ...

Issuance of Annual Statements of GPF Accounts (CCO-9) for the year 2020-21 on 1st April, 2021 – regarding.

Issuance of Annual Statements of GPF Accounts (CCO-9) for the year 2020-21 on 1st April, 2021 - regarding.

हर काम, देश के नाम/ Every Work, For the Na ...