Tag: GPF

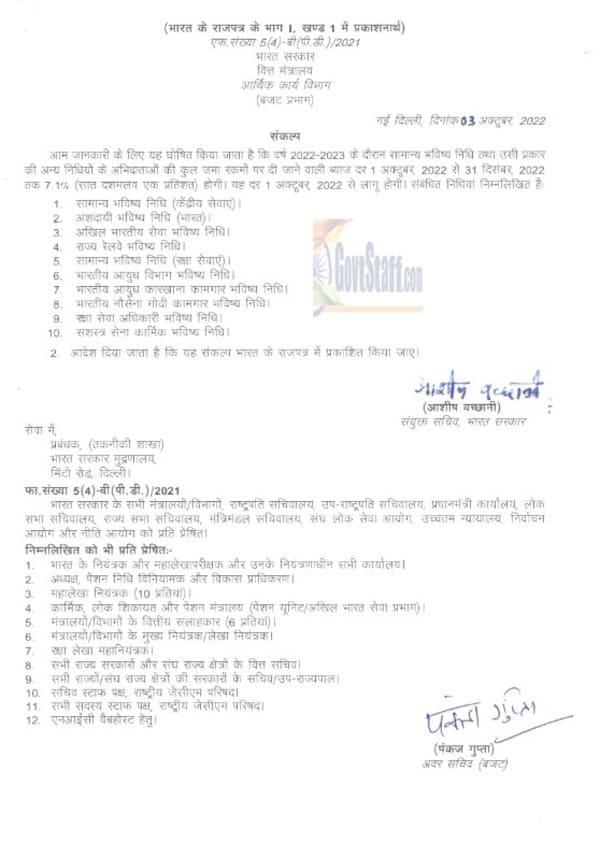

GPF Interest rates @ 7.1% for Q3 of FY 2022-2023 from 1st October, 2022 to 31st December 2022

GPF Interest rates @ 7.1% for Q3 of FY 2022-2023 from 1st October, 2022 to 31st December 2022

(TO BE PUBLISHED IN PART I SECTION 1 OF GAZETTE OF IND ...

GPF Subscription : Sum of the monthly subscriptions during a financial year shall not exceed Rs. 5 Lakh

GPF Subscription : Sum of the monthly subscriptions during a financial year shall not exceed Rs. 5 Lakh

MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND ...

Misappropriation/manipulation of PF Ledgers – Railway Board advised to take extreme precautions while providing access to officials for different modules in IPAS – Railway Board RBA No.46/2022

Misappropriation/manipulation of PF Ledgers - Railway Board advised to take extreme precautions while providing access to officials for different modu ...

Missing entries in GPF accumulation of subscriber: DoP&PW OM dated 18.08.2022

Missing entries in GPF accumulation of subscriber: DoP&PW OM dated 18.08.2022

No. 3/7/2020-P&PW (F)/6728

Government of India

Ministry of Pe ...

Calculation and deduction of taxable interest relating to contribution in a provident fund exceeding specified limit – Illustrations, CBDT Notification

Calculation and deduction of taxable interest relating to contribution in a provident fund exceeding specified limit - Illustrations, CBDT Notificatio ...

Rate of Interest on GPF and other similar funds for Q1 of FY 2022-2023 from 1st April, 2022 to 30th June, 2022

Rate of Interest on GPF and other similar funds for Q1 of FY 2022-2023 from 1st April, 2022 to 30th June, 2022

(TO BE PUBLISHED IN PART I SECTION 1 O ...

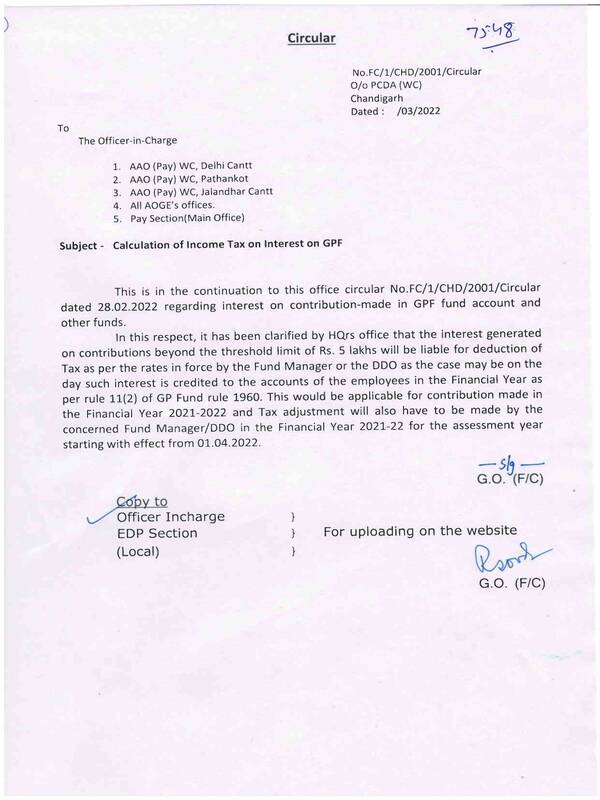

Calculation of Income Tax on Interest on GPF

Calculation of Income Tax on Interest on GPF

7548

Circular

No.FC/1/CHD/2001/Circular

O/o PCDA (WC)

Chandigarh

Dated: /03/2022

To

The Office ...

Calculation of Income Tax on Interest of GPF – Issues raised and clarification by DAD (HQ)

Calculation of Income Tax on Interest of GPF - Issues raised and clarification by DAD (HQ)

रक्षा लेखा विभाग (र.ले.वि.) मुख्यालय

उलान बटार रोड, पालम, ...

Income Tax deduction on GPF – CDA Guwahati web circulation

Income Tax deduction on GPF - CDA Guwahati web circulation

Through CDA GUWAHATI WEBSITE

रक्षा लेखा नियंत्रक का कार्यालय, गुवाहाटी उदयन विहार, नारंगी ...

Calculation of taxable interest relating to contribution in a provident fund, exceeding specified limit w.e.f F.Y 2021-22

Calculation of taxable interest relating to contribution in a provident fund, exceeding specified limit w.e.f F.Y 2021-22

No. TA-3-07001/7/2021-TA-II ...