Tag: Finance Bill

Union Budget 2025-26: FAQ on Income-Tax Benefits under New Regime

Union Budget 2025-26: FAQ on Income-Tax Benefits under New Regime

FAQ.1: Personal Income-tax reforms with special focus on middle class

Q.1. What is ...

Union Budget 2025-26: Rs. 12 Lakh Income Tax-Free, Standard Deduction Increased to Rs. 75,000 for Salaried Individuals/ 12 लाख रुपये तक की आय पर कोई आयकर नहीं, 75,000 रुपये की मानक कटौती

Union Budget 2025-26: Rs. 12 Lakh Income Tax-Free, Standard Deduction Increased to Rs. 75,000 for Salaried Individuals/ 12 लाख रुपये तक की आय पर ...

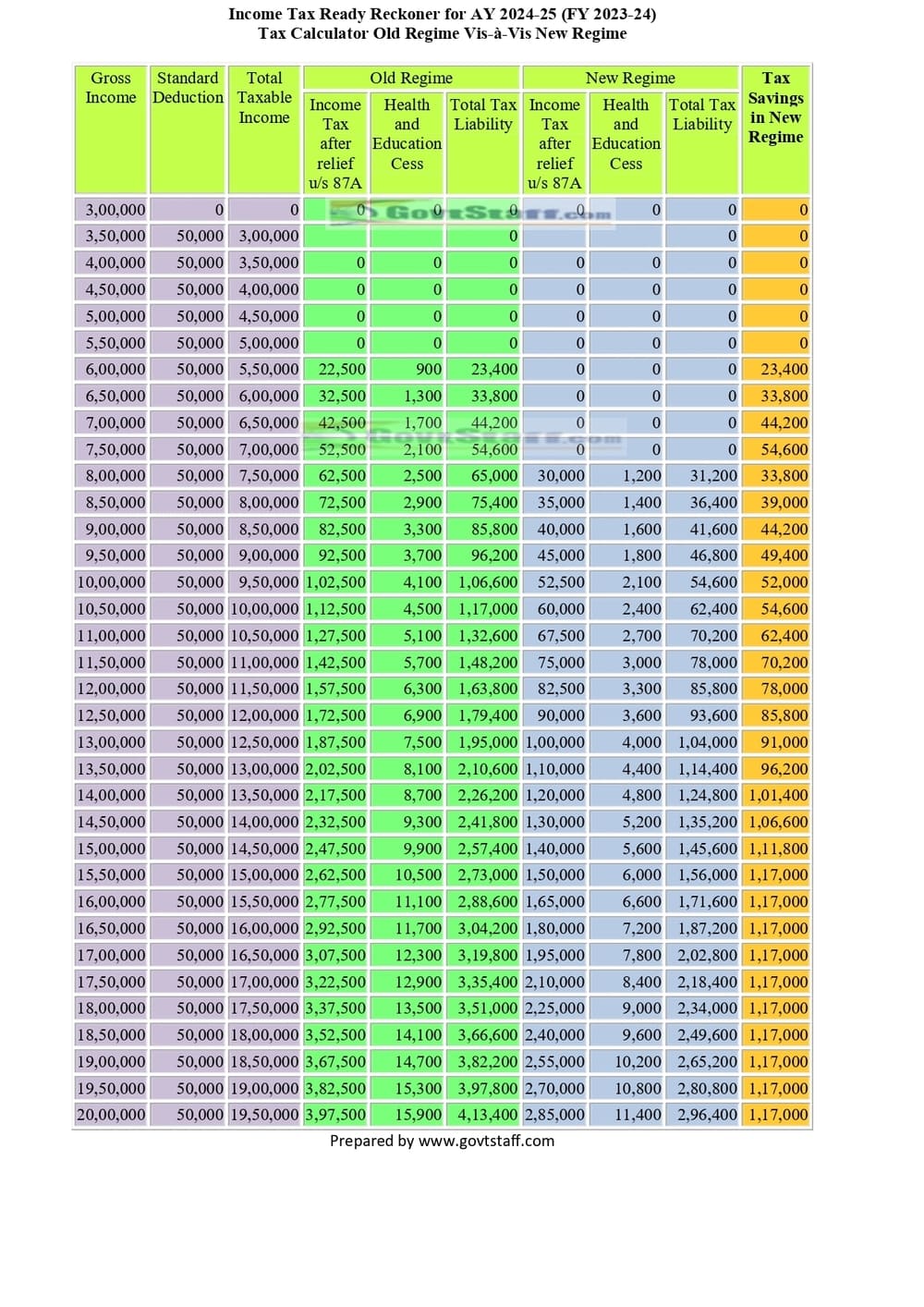

Income Tax Ready Reckoner for AY 2024-25 (FY 2023-24) : Tax Calculator Old Regime Vis-à-Vis New Regime

Income Tax Ready Reckoner for AY 2024-25 (FY 2023-24) : Tax Calculator Old Regime Vis-à-Vis New Regime

Income Tax Calculator for Salaried persons as ...

Income Tax Rates, TDS on Salaries and Rebate under Section 87A – Finance Bill 2023- Budget 2023-24

Income Tax Rates, TDS on Salaries and Rebate under Section 87A - Finance Bill 2023 - Budget 2023-24

FINANCE BILL, 2023

PROVISIONS RELATING TO

DIR ...