Tag: CBDT

Guidelines on Air Travel on Tours/LTC – Proposal for seeking relaxation reg

Guidelines on Air Travel on Tours/LTC - Proposal for seeking relaxation reg

F.No.A.26017/14/2020.Ad.11.A

Government of India

Ministry of Finance

D ...

Income Tax (30th Amendment) Rules 2021 – CBDT Notification dated 24-09-2021

Income Tax (30th Amendment) Rules 2021 - CBDT Notification dated 24-09-2021

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TA ...

IT Circular No 17: Due date of furnishing Return of Income Tax for A.Y. 2021-22 extended to 31st December, 2021

IT Circular No 17: Due date of furnishing Return of Income Tax for A.Y. 2021-22 extended to 31st December, 2021

Circular No.17/2021

F. No. 225/49/20 ...

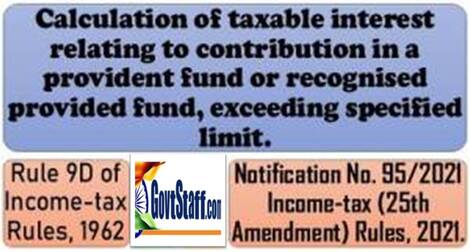

Calculation of taxable interest relating to contribution in a provident fund: Rule 9D of Income-tax Rules, 1962 – IT 25th Amendment Rules 2021

Calculation of taxable interest relating to contribution in a provident fund: Rule 9D of Income-tax Rules, 1962 – IT 25th Amendment Rules 2021

MINIST ...

Relief to Taxpayers : Extension of time limits of certain compliances in view of the severe pandemic: CBDT Circular No. 9 dated 20.05.2021

Relief to Taxpayers : Extension of time limits of certain compliances in view of the severe pandemic: CBDT Circular No. 9 dated 20.05.2021

Circular N ...

New Income Tax Return Forms for AY 2021-22: वर्ष 2021-22 के लिए नए आयकर रिटर्न फॉर्म

New Income Tax Return Forms for AY 2021-22: वर्ष 2021-22 के लिए नए आयकर रिटर्न फॉर्म

Ministry of Finance

प्रविष्टि तिथि: 01 APR 2021

The Central Bo ...

Income Tax due dates : extension of various limitation dates – Notification no. 10/2021 in S.O. 966 (E) dated 27/02/2021

Income Tax due dates : extension of various limitation dates – Notification no. 10/2021 in S.O. 966 (E) dated 27/02/2021

Date for passing of assessme ...

आईटीआर फाइलिंग की अंतिम तिथि फिर से बढ़ाने के सम्बन्ध में वित्त मंत्रालय का स्पष्टीकरण

आईटीआर फाइलिंग की अंतिम तिथि फिर से बढ़ाने के सम्बन्ध में वित्त मंत्रालय का स्पष्टीकरण

आयकर रिटर्न (आईटीआर) फाइलिंग की अन्तिम तिथि 10 जनवरी 202 ...

Income Tax Circular No. 20/2020: TDS and Tax on Salary Section 192 FY 2020-21 & AY 2021-22

TDS and Tax on Salary Section 192 FY 2020-21 AY 2021-22 – CBDT issued Income Tax Circular No. 20/2020 dated 03rd December 2020 which contains provisi ...

Notional Increment/Re-Fixation of Pensionary Benefits for retired on 30th June: Instructions to dispose Representations and defend Court Cases

Notional Increment/Re-Fixation of Pensionary Benefits for retired on 30th June: Instructions to dispose Representations and defend Court Cases

F. No. ...