Tag: CBDT

Effect of pension cut on the amount of family pension, in case of death of retired government servant during the currency period – Clarification by CBDT

Effect of pension cut on the amount of family pension, in case of death of retired government servant during the currency period - Clarification by CB ...

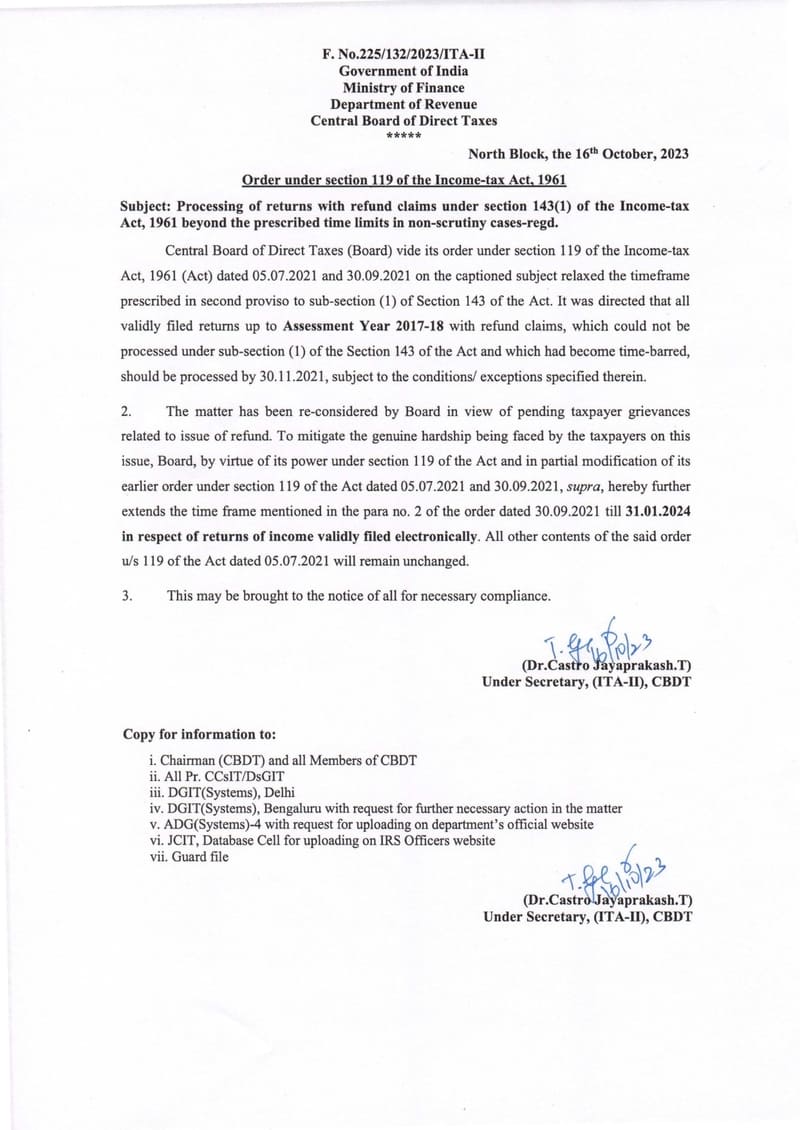

Processing of returns with refund claims under section 143(1) of the Income-tax Act, 1961 beyond the prescribed time limits in non-scrutiny cases – CBDT order under section 119 of the Income-tax Act, 1961

Processing of returns with refund claims under section 143(1) of the Income-tax Act, 1961 beyond the prescribed time limits in non-scrutiny cases - CB ...

Deduction of Income-tax at any lower rate or no deduction of Income-tax under sub-section (1) of section 197 of the Income-tax Act, 1961 through TRACES – Procedure, format and standards for filling an application for grant of certificate under sub-rule (4) and its proviso of Rule 28AA of Income Tax Rules, 1962

Deduction of Income-tax at any lower rate or no deduction of Income-tax under sub-section (1) of section 197 of the Income-tax Act, 1961 through TRACE ...

Income tax (Eighteenth Amendment), Rules, 2023: Perquisites – Valuation of residential accommodation provided by the employer

Income tax (Eighteenth Amendment), Rules, 2023: Perquisites – Valuation of residential accommodation provided by the employer

MINISTRY OF FINANCE

(D ...

Income-tax (Seventeenth Amendment) Rules, 2023 – Rate of exchange for the purpose of deduction of tax at source on income payable in foreign currency

Income-tax (Seventeenth Amendment) Rules, 2023 – Rate of exchange for the purpose of deduction of tax at source on income payable in foreign currency

...

Guidelines under clause (10D) of section 10 of the Income-tax Act, 1961 – Exemption of Income-tax on any sum received under a Life Insurance Policy : CBDT Circular No. 15 of 2023

Guidelines under clause (10D) of section 10 of the Income-tax Act, 1961 – Exemption of Income-tax on any sum received under a Life Insurance Policy : ...

Provisions relating to Charitable and Religious Trusts – Clarification by CBDT vide Circular No. 6 of 2023

Provisions relating to Charitable and Religious Trusts - Clarification by CBDT vide Circular No. 6 of 2023

Circular No. 6 of 2023

F. No.370133/06/20 ...

Increased limit for tax exemption on leave encashment for non-government salaried employees notified – CBDT Press Release dated 25.05.2023

Increased limit for tax exemption on leave encashment for non-government salaried employees notified - CBDT Press Release dated 25.05.2023

Government ...

SoP for filing of APAR by ORUs and approval by Custodians on SPARROW from the Reporting Year 2022-23 onwards – CBDT order dated 5.04.2023

SoP for filing of APAR by ORUs and approval by Custodians on SPARROW from the Reporting Year 2022-23 onwards - CBDT order dated 5.04.2023

GOVERNMENT ...

Procedure, format and standards for filling an application in Form No. 15C or Form No. 15D for grant of certificate for no-deduction of income-tax under sub-section (3) of section 195 of the Income Tax Act, 1961 through TRACES – IT Notification No. 01/2023

Procedure, format and standards for filling an application in Form No. 15C or Form No. 15D for grant of certificate for no-deduction of income-tax und ...