Category: Income Tax

Income Tax (3rd Amendment) Rules 2021: Revised Form No. 12BA, Revised Form No. 16 for Part B (Annexure) and Form No. 24Q Annexure-II

Income Tax (3rd Amendment) Rules 2021: Revised Form No. 12BA, Revised Form No. 16 for Part B (Annexure) and Form No. 24Q Annexure-II

MINISTRY OF FINA ...

Income Tax due dates : extension of various limitation dates – Notification no. 10/2021 in S.O. 966 (E) dated 27/02/2021

Income Tax due dates : extension of various limitation dates – Notification no. 10/2021 in S.O. 966 (E) dated 27/02/2021

Date for passing of assessme ...

Rationalisation of Tax free Income on Provident Funds: IRTSA writes to Finance Minister

Rationalisation of Tax free Income on Provident Funds: IRTSA writes to Finance Minister

INDIAN RAILWAYS TECHNICAL SUPERVISORS ASSOCIATION

(Estd. 196 ...

Relaxation for Filing of Income Tax Returns due to coronavirus COVID-19 pandemic condition

Relaxation for Filing of Income Tax Returns due to coronavirus COVID-19 pandemic condition

In view of the pandemic and considering the challenges fac ...

आईटीआर फाइलिंग की अंतिम तिथि फिर से बढ़ाने के सम्बन्ध में वित्त मंत्रालय का स्पष्टीकरण

आईटीआर फाइलिंग की अंतिम तिथि फिर से बढ़ाने के सम्बन्ध में वित्त मंत्रालय का स्पष्टीकरण

आयकर रिटर्न (आईटीआर) फाइलिंग की अन्तिम तिथि 10 जनवरी 202 ...

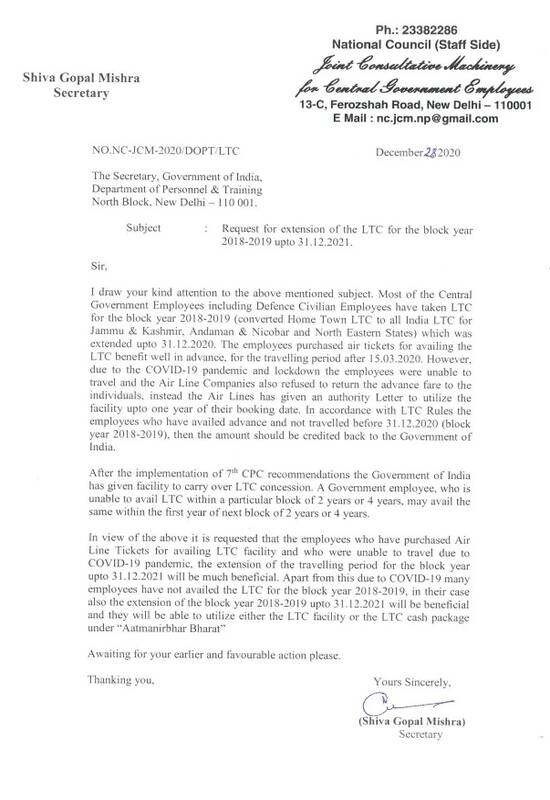

Extension of LTC Block Year 2018-2019 up to 31.12.2021: NCJCM Staff Side request

Extension of LTC Block Year 2018-2019 up to 31.12.2021: NCJCM Staff Side request

Ph.: 23382286

National Council (Staff Side)

Joint Consultative Mac ...

Recovery of Income Tax for the F.Y. 2020-21 (A.Y. 2021-22) – Self Declaration Form

Recovery of Income Tax for the F.Y. 2020-21 (A.Y. 2021-22) – Self declaration Form

रक्षा लेखा प्रधान नियंत्रक (मध्य कमान)

करियप्पा मार्ग, लखनउ छाव ...

Income Tax Circular No. 20/2020: TDS and Tax on Salary Section 192 FY 2020-21 & AY 2021-22

TDS and Tax on Salary Section 192 FY 2020-21 AY 2021-22 – CBDT issued Income Tax Circular No. 20/2020 dated 03rd December 2020 which contains provisi ...

Income Tax Return : Instruction for filling ITR-1 SAHAJ

Income Tax Return : Instruction for filling ITR-1 SAHAJ

Instructions for filling ITR-1 SAHAJ

A.Y. 2020-21

General Instructions

These instruction ...

CBDT Circular : Condonation of delay under section 119 (2) (b) of the Income-tax Act, 1961 in filing of Form No. 10 BB for Assessment Year 2016-17 and subsequent years – Reg

CBDT Circular : Condonation of delay under section 119 (2) (b) of the Income-tax Act, 1961 in filing of Form No. 10 BB for Assessment Year 2016-17 and ...