Category: Income Tax

Income-tax Exemption for payment of deemed LTC fare for non-Central Government employees: Finance Ministry News

Income-tax Exemption for payment of deemed LTC fare for non-Central Government employees: Finance Ministry News

Ministry of Finance

Income-tax Exe ...

Finmin : Extension of due date of furnishing of Income Tax Returns and Audit Reports – reg./ आयकर रिटर्न और लेखा परीक्षण रिपोर्ट दाखिल करने की अंतिम तिथि को आगे बढ़ाया गया

Extension of due date of furnishing of Income Tax Returns and Audit Reports - reg. / आयकर रिटर्न और लेखा परीक्षण रिपोर्ट दाखिल करने की अंतिम तिथि को आ ...

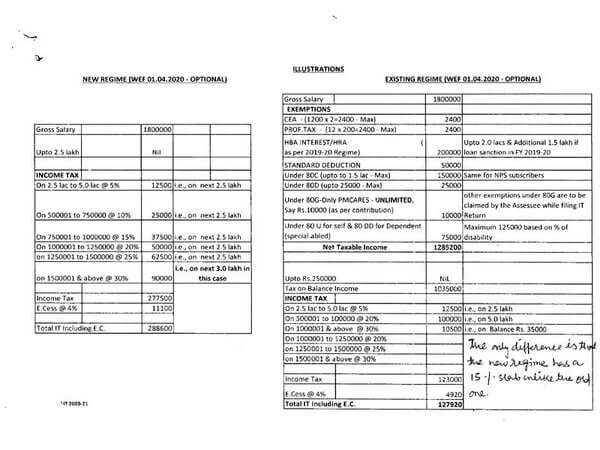

Income Tax: Exercise of Options for choosing Old and New regimes of Income Tax during F.Y. 2020-21

Income Tax: Exercise of Options for choosing Old and New regimes of Income Tax during F.Y. 2020-21

कार्यात्रय रक्षा लेखा नियंत्रक :

OFFICE OF THE CO ...

Income Tax: Extension of deadlines for filing Returns and other related compliances

Income Tax: Extension of deadlines for filing Returns and other related compliances

Amidst the ongoing humanitarian and economic steps to address the ...

Prime Minister Narendra Modi launches platform for “Transparent Taxation – Honouring the Honest”/ प्रधानमंत्री श्री नरेन्द्र मोदी ने “पारदर्शी कराधान – ईमानदार का सम्मान” नाम से एक मंच का शुभारंभ किया

Prime Minister Narendra Modi launches platform for “Transparent Taxation - Honouring the Honest”/ प्रधानमंत्री श्री नरेन्द्र मोदी ने “पारदर्शी कराधान ...

Income Tax Return: अब 30 सितंबर तक भर सकेंगे 2018-19 का ITR, पहले इसे 31 जुलाई तक दाखिल करना था, वित्त वर्ष 2019-20 के लिए आयकर रिटर्न भरने की तारीख पहले ही बढ़ा दी गई थी

Income Tax Return: अब 30 सितंबर तक भर सकेंगे 2018-19 का ITR, पहले इसे 31 जुलाई तक दाखिल करना था, वित्त वर्ष 2019-20 के लिए आयकर रिटर्न भरने की तारीख प ...

Income Tax Circular No. 13/2020 : One-time relaxation for AY 2015-16 to 2019-20 which are pending due to non-filing of ITR V form and processing of such returns

Income Tax Circular No. 13/2020 : One-time relaxation for AY 2015-16 to 2019-20 which are pending due to non-filing of ITR V form and processing of s ...

Rule 12CB of IT Act 1962 – Income-tax (18th Amendment) Rules, 2020: Statement of income paid or credited by an investment fund to its unit holder

Rule 12CB of IT Act 1962 – Income-tax (18th Amendment) Rules, 2020: Statement of income paid or credited by an investment fund to its unit holder

MIN ...

Clarification in relation to notification issued under clause (v): Section 194N of the Income-tax Act, 1961

Clarification in relation to notification issued under clause (v): Section 194N of the Income-tax Act, 1961

Circular no. 14/2020

F.No. 370142/27/202 ...

New Form 26AS: Faceless hand-holding for the honest Taxpayers/ नया फॉर्म 26एएस: ईमानदार करदाताओं का ‘फेसलेस मददगार’

New Form 26AS: Faceless hand-holding for the honest Taxpayers/ नया फॉर्म 26एएस: ईमानदार करदाताओं का ‘फेसलेस मददगार’

पत्र सूचना कार्यालय / Pre ...