Category: Income Tax

Income-tax Act, 2025 – BILL No. 24 OF 2025

Income-tax Act, 2025 – BILL No. 24 OF 2025

The Gazette of India

CG-DL-E-13022025-261003

EXTRAORDINARY

PART II — Section 2

PUBLISHED BY AUTHORITY

...

Union Budget 2025-26: FAQ on Income-Tax Benefits under New Regime

Union Budget 2025-26: FAQ on Income-Tax Benefits under New Regime

FAQ.1: Personal Income-tax reforms with special focus on middle class

Q.1. What is ...

Union Budget 2025-26: Rs. 12 Lakh Income Tax-Free, Standard Deduction Increased to Rs. 75,000 for Salaried Individuals/ 12 लाख रुपये तक की आय पर कोई आयकर नहीं, 75,000 रुपये की मानक कटौती

Union Budget 2025-26: Rs. 12 Lakh Income Tax-Free, Standard Deduction Increased to Rs. 75,000 for Salaried Individuals/ 12 लाख रुपये तक की आय पर ...

Exemption of Tax on Medical Expense : Income Tax department granted approval to The Panacea Multi Super Specialty Hospital, Kanpur

Exemption of Tax on Medical Expense : Income Tax department granted approval to The Panacea Multi Super Specialty Hospital, Kanpur

OFFICE OF THE

PRI ...

Benefits for Senior Citizens and Super Senior Citizens under Income Tax Act, 1961

Benefits for Senior Citizens and Super Senior Citizens under Income Tax Act, 1961

C/7099/I-Tax/SAPCS/2027

24 May 2024

एकीकृत मुख्यालय रक्षा मंत्रा ...

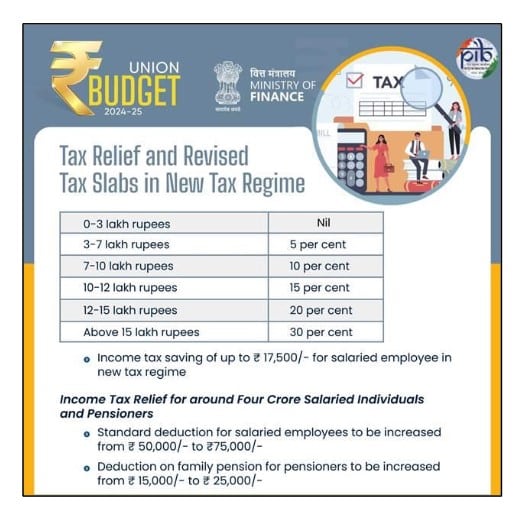

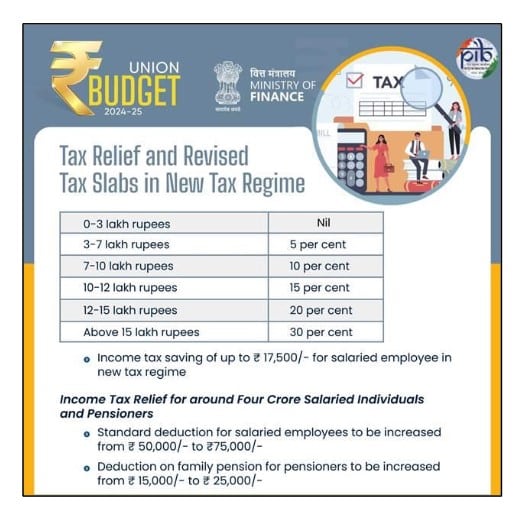

Tax Relief and Revised Tax Slabs in New Tax Regime – Standard deduction increased from 50,000 to 75,000

Tax Relief and Revised Tax Slabs in New Tax Regime – Standard deduction increased from 50,000 to 75,000

Ministry of Finance

GOVERNMENT MAKES NEW T ...

Income Tax 2024: Budget 2024-25 Introduces Enhanced Deductions and Revised Tax Slabs

Income Tax 2024: Budget 2024-25 Introduces Enhanced Deductions and Revised Tax Slabs

Celebrating Income Tax Day 2024 : A Journey of Transformation

B ...

Deduction of Income tax for the FY 2024-25 – Guidelines emphasizing early start, arrears, proof submission, and system automation.

Deduction of Income tax for the FY 2024-25 – Guidelines emphasizing early start, arrears, proof submission, and system automation.

Principal Controll ...

Implementation of e-Verification Scheme-2021: Taxpayers are being informed of mismatch through SMS and emails by Income Tax Department

Implementation of e-Verification Scheme-2021: Taxpayers are being informed of mismatch through SMS and emails by Income Tax Department

Ministry of Fi ...

Finance Act 2023 : Amendments of the Income Tax Act 1961 – CBDT Circular No. 1/2024

Finance Act 2023 : Amendments of the Income Tax Act 1961 - CBDT Circular No. 1/2024

CIRCULAR NO. 1/2024

F. No. 370142/38/2023

Government of India

Mini ...