Day: March 28, 2024

Deduction of Income tax for the FY 2024-25 – Guidelines emphasizing early start, arrears, proof submission, and system automation.

Deduction of Income tax for the FY 2024-25 – Guidelines emphasizing early start, arrears, proof submission, and system automation.

Principal Controll ...

Sanction of House Building Advance (HBA) in cases of joint ownership with spouse for outright purchase of a new flat wherein spouse of railway servant is not a railway/government servant: RBE No. 29/2024

Sanction of HBA in cases of joint ownership with spouse for outright purchase of a new flat wherein spouse of railway servant is not a railway/governm ...

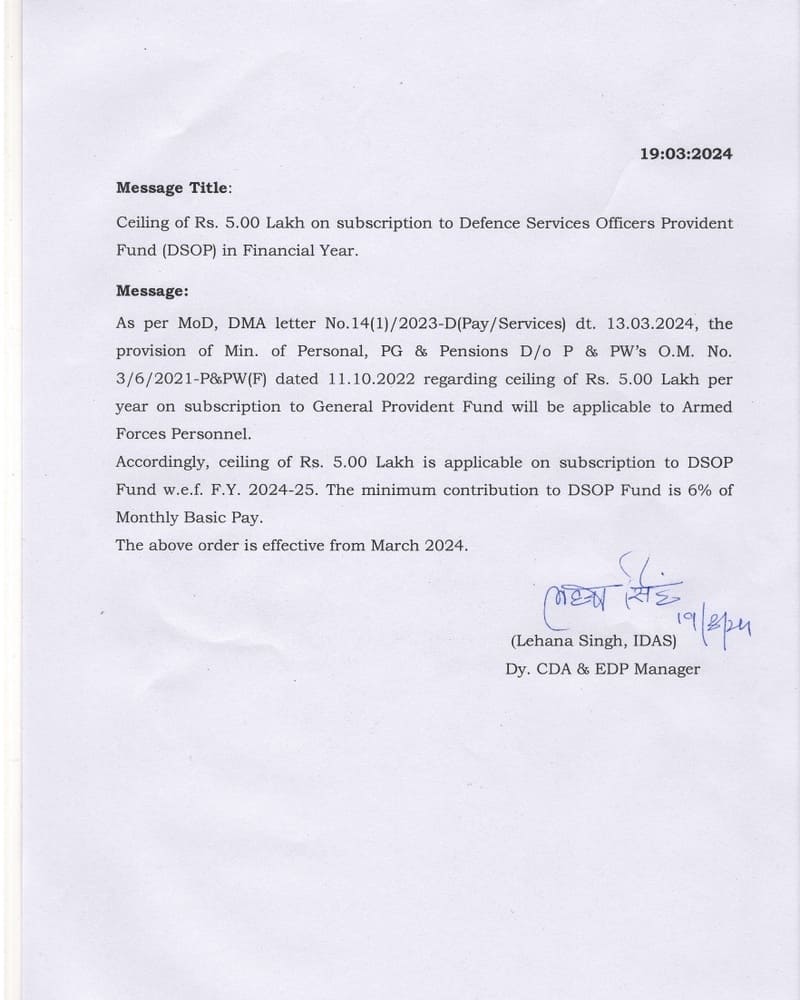

Applicability of ceiling of Rs. 5.00 Lakh on subscription to Defence Services Officers Provident Fund (DSOP) w.e.f. Financial Year 2024-25: PCDA(O) Message dated 19.03.2024

Applicability of ceiling of Rs. 5.00 Lakh on subscription to Defence Services Officers Provident Fund (DSOP) w.e.f. Financial Year 2024-25: PCDA(O) Me ...

Important update on Karma Points on iGOT Karmyogi Portal – Department of Posts order dated 19.03.2024

Important update on Karma Points on iGOT Karmyogi Portal - Department of Posts order dated 19.03.2024

F.No. Tr-01/7/2022-Training-DOP

Government of ...